In the rapidly evolving world of cryptocurrency, cross-chain bridges have become essential for users looking to interact with multiple blockchain ecosystems. These bridges facilitate the transfer of assets across different networks, enabling users to leverage the unique features of each. However, a common question arises among users: 跨链桥兑换要多久? Understanding the timeframe for these transactions is vital for anyone looking to optimize their crypto activities. In this article, we’ll explore cross-chain bridges in depth, discussing how they work, the factors affecting transaction times, and what users can expect in terms of speed and efficiency.

What Are Cross-Chain Bridges?

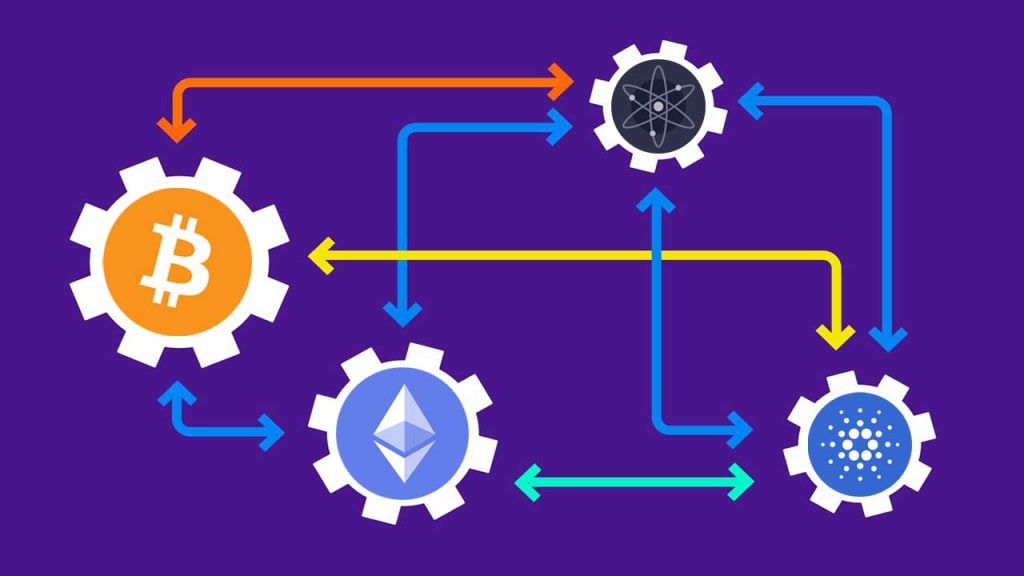

Cross-chain bridges (跨链桥兑换要多久) are decentralized applications (dApps) designed to enable the seamless transfer of assets between different blockchain networks. Unlike traditional exchanges that require users to convert assets within a single network, cross-chain bridges allow users to move their tokens across various ecosystems. This capability is crucial in a landscape where numerous blockchains offer distinct advantages—such as lower fees, faster transaction speeds, or specialized smart contract capabilities.

How Do They Work?

Cross-chain bridges typically utilize smart contracts to manage transactions. When a user wants to transfer tokens from one blockchain to another, they deposit their tokens into a smart contract on the original blockchain. The smart contract locks these tokens and then issues a corresponding amount of wrapped tokens (or a similar representation) on the target blockchain. This process often involves a series of confirmations across both networks, ensuring that the transaction is secure and accurately recorded.

Why Use Cross-Chain Bridges?

Benefits of Interoperability

- Access to Diverse Ecosystems: Each blockchain has its unique set of features. For instance, Ethereum has a vibrant DeFi ecosystem, while Binance Smart Chain offers lower transaction fees. Cross-chain bridges allow users to tap into these diverse ecosystems without being restricted to a single chain.

- Enhanced Liquidity: By enabling asset transfers across chains, bridges can enhance liquidity, allowing users to find better trading opportunities and reduce slippage.

- Portfolio Diversification: Users can easily manage and diversify their crypto holdings by moving assets across different chains.

Use Cases in the Crypto Ecosystem

Cross-chain bridges have several practical applications, including:

- Decentralized Finance (DeFi): Users can move tokens to participate in yield farming or liquidity provision on different DeFi platforms.

- Non-Fungible Tokens (NFTs): Artists and collectors can transfer their NFTs across various marketplaces to reach broader audiences.

- Cross-Chain Swaps: Users can trade assets directly between different chains without needing a centralized exchange.

Factors Affecting Transaction Timeframes

When considering 跨链桥兑换要多久, several key factors can influence transaction durations:

1. Network Congestion

Network congestion occurs when too many transactions are being processed simultaneously. During high-traffic periods, such as major market events or crypto launches, users may experience delays. Each blockchain has its own capacity limits, and exceeding these can slow down processing times.

2. Type of Assets Being Transferred

The assets themselves can affect transaction times. Some tokens may require more confirmations or take longer to process due to the underlying technology. For example, tokens on proof-of-work chains like Bitcoin often take longer than those on proof-of-stake chains.

3. Confirmation Times on Blockchains

Each blockchain operates under its own consensus mechanism, which determines how quickly transactions are confirmed. For instance, Ethereum transactions might take around 15 seconds on average, while Bitcoin transactions could take 10 minutes or more. These confirmation times directly impact the speed of cross-chain transactions.

4. Bridge Efficiency

Not all cross-chain bridges are created equal. The underlying technology, architecture, and protocols used can significantly influence transaction times. Some bridges prioritize speed, while others may focus on security or decentralization, which can lead to variations in performance.

Average Time Frames for Cross-Chain Transactions

On average, users can expect cross-chain transactions to take anywhere from a few minutes to several hours, depending on the factors mentioned above. Here’s a rough breakdown of average transaction times for some popular bridges:

- Binance Bridge: Typically takes 5-30 minutes under normal conditions.

- Polygon Bridge: Generally completed transactions in about 5-15 minutes.

- Thorchain: Users can expect transaction times around 30 minutes, although this may vary based on network conditions.

These averages can fluctuate based on real-time blockchain activity and specific use cases.

How to Choose a Cross-Chain Bridge

When selecting a cross-chain bridge,(跨链桥兑换要多久) users should consider several key factors:

1. Speed vs. Security

While speed is essential, security should always be a priority. Researching a bridge’s security history and user reviews can help gauge its reliability. Look for bridges that have undergone security audits by reputable firms.

2. Supported Chains

Ensure that the bridge supports the specific blockchains you intend to use. Not all bridges can transfer assets between every blockchain, so check compatibility before proceeding.

3. Fees and Costs

Transaction fees can vary widely between bridges. Some may charge higher fees for faster processing times, while others offer lower fees at the expense of speed. Compare costs to find a balance that works for you.

4. User Experience

A user-friendly interface can make a significant difference in your experience. Choose a bridge that offers clear instructions and a straightforward process for executing transactions.

The Role of Smart Contracts

Smart contracts are at the heart of how cross-chain bridges operate. They automate the process, ensuring that the terms of the transaction are met before any assets are released. Here’s how they typically work:

1. Locking Assets

When initiating a transfer, the smart contract locks the original tokens on the source blockchain. This ensures that the tokens cannot be spent elsewhere during the transfer process.

2. Issuing Wrapped Tokens

Once the original tokens are locked, the smart contract issues a corresponding amount of wrapped tokens on the destination blockchain. This mechanism ensures that the overall supply of the asset remains unchanged.

3. Finalizing Transactions

After the transaction is confirmed on both chains, the wrapped tokens can be used just like the original tokens on the new blockchain. This process involves multiple confirmations and verifications, which can introduce delays.

Real-World Examples of Cross-Chain Transactions

To better understand how cross-chain bridges operate, let’s examine a few real-world examples:

1. Binance Smart Chain to Ethereum

A user may want to transfer their BNB tokens from Binance Smart Chain to Ethereum. By using the Binance Bridge, the user deposits their BNB into the bridge’s smart contract, which locks the tokens. The bridge then issues the equivalent amount of wrapped BNB on Ethereum. Under optimal conditions, this process can take between 5 to 30 minutes.

2. Ethereum to Avalanche

In another scenario, a user wishes to transfer ETH to the Avalanche network. Using the AnySwap bridge, the user locks their ETH and receives a corresponding amount of wrapped ETH on Avalanche. This transaction can take approximately 10-20 minutes, depending on network conditions.

Challenges and Risks

While cross-chain bridges offer significant advantages, they come with challenges and risks:

1. Security Vulnerabilities

Bridges can be susceptible to various attacks, such as hacks or exploits. For instance, poorly designed smart contracts can lead to asset loss if vulnerabilities are not addressed. Always use reputable bridges with a history of security audits.

2. Impact of Delays on Users

Transaction delays can be frustrating, especially if users are trying to take advantage of market movements. If a transaction takes longer than expected, users may miss out on opportunities or face unfavorable price changes.

3. Lack of Regulation

The decentralized nature of cross-chain bridges means they operate outside traditional regulatory frameworks. While this can provide freedom and flexibility, it also means users bear the full responsibility for their transactions.

Future of Cross-Chain Bridges

The future of cross-chain bridges (跨链桥兑换要多久) looks promising, with ongoing innovations aimed at improving transaction speeds, security, and user experience. Several trends are emerging:

1. Enhanced Security Protocols

Developers are continually working to enhance security measures, including multi-signature wallets and more robust smart contract designs. These advancements aim to reduce the risk of hacks and exploits.

2. Improved User Interfaces

As cross-chain technology matures, we can expect user interfaces to become more intuitive, making it easier for newcomers to navigate the complexities of cross-chain transactions.

3. Increased Interoperability

The growing demand for interoperability among blockchains is driving innovation. New protocols and standards are being developed to facilitate smoother and faster transactions across chains.

Conclusion

Understanding the timeframe for cross-chain bridge (跨链桥兑换要多久) transactions is crucial for effectively managing your crypto assets. As users explore the vast landscape of blockchain networks, being informed about the factors that influence transaction times can lead to more strategic decision-making. Cross-chain bridges not only enhance the flexibility and utility of cryptocurrencies but also open up a world of possibilities for users seeking to maximize their investments.

FAQs

What is a cross-chain bridge?

A cross-chain bridge is a decentralized application that facilitates the transfer of assets between different blockchain networks.

How long does a typical transaction take?

Transaction times can vary from a few minutes to several hours, depending on factors like network congestion and asset type.

Are cross-chain bridges secure?

Security varies by bridge. It’s essential to research and choose reputable bridges that have undergone security audits.

Can I track my transaction?

Yes, most cross-chain bridges provide tracking features that allow users to monitor the status of their transactions.

What happens if a transaction fails?

In the event of a failure, the original assets remain secure in the original blockchain until the issue is resolved.